Discover expert tips on how to report a foreign gift smoothly

Wiki Article

Understanding the Kinds Of Foreign Presents: Just How to Efficiently Report Them

Recognizing international gifts is essential for organizations passing through intricate coverage demands (report a foreign gift). These presents can differ substantially, falling under monetary and non-monetary categories. Each kind presents distinct obstacles in appraisal and conformity. Organizations needs to be aware of the lawful and moral implications included. Reliable administration and reporting demand clear standards and normal training. The question stays: just how can companies guarantee they satisfy these commitments while preserving openness and accountability?Meaning and Introduction of Foreign Gifts

Foreign gifts are advantages or items obtained from foreign entities, which can include governments, companies, or people. These gifts might take numerous kinds, consisting of substantial things, solutions, or various other types useful that hold worth. The significance of foreign presents often lies in their prospective to influence connections between people, companies, or nations. They can be a way of diplomacy, showing goodwill or fostering cooperation. However, the approval of such presents raises legal and moral factors to consider, specifically pertaining to openness and potential conflicts of interest. Recipients should navigate complex guidelines that regulate the reporting and approval of foreign gifts, making certain compliance with both international and residential legislations. Recognizing the meaning and implications of international gifts is important for people and organizations to maintain honesty and accountability in their transactions with foreign entities. This fundamental understanding sets the phase for a much deeper expedition of the different sorts of foreign gifts and their reporting needs.Kinds Of Foreign Presents: Monetary vs. Non-Monetary

Gifts from abroad can be classified into two primary kinds: monetary and non-monetary. Monetary presents encompass direct monetary payments, such as cash or checks, which can greatly affect the recipient's financial standing. These gifts are typically simple to value and report, as they involve clear monetary amounts.Non-monetary presents, on the various other hand, include tangible things such as clothes, artwork, or mementos, in addition to intangible offerings like services or experiences. While these presents might not have a straight financial effect, they can hold significant nostalgic or social worth. Valuing non-monetary presents can be extra intricate, as it typically calls for evaluating the thing's market well worth or value to the recipient. Recognizing these 2 categories is important for accurate reporting, making sure conformity with laws maintaining and regarding foreign presents transparency in economic dealings.

Legal and Moral Implications of Receiving Foreign Gifts

While the appeal of obtaining gifts from abroad might seem innocuous, the legal and honest ramifications related to such transactions can be substantial. Recipients should browse complicated guidelines that regulate the acceptance of international presents, as failure to do so may lead to legal consequences, including sanctions or penalties. Fairly, the approval of gifts from foreign entities can lead to assumptions of preference or disputes of rate of interest, especially for people ready of power or public count on. Such perceptions can threaten the integrity of institutions and deteriorate public self-confidence. Furthermore, the potential for international influence increases issues relating to nationwide safety and the honesty of decision-making procedures. Because of this, people need to thoroughly consider not only the legitimacy of accepting foreign presents but additionally the more comprehensive ramifications on their credibilities and the establishments they represent. Inevitably, thoughtful deliberation is important to maintain both lawful compliance and honest standards.Reporting Needs for Foreign Presents

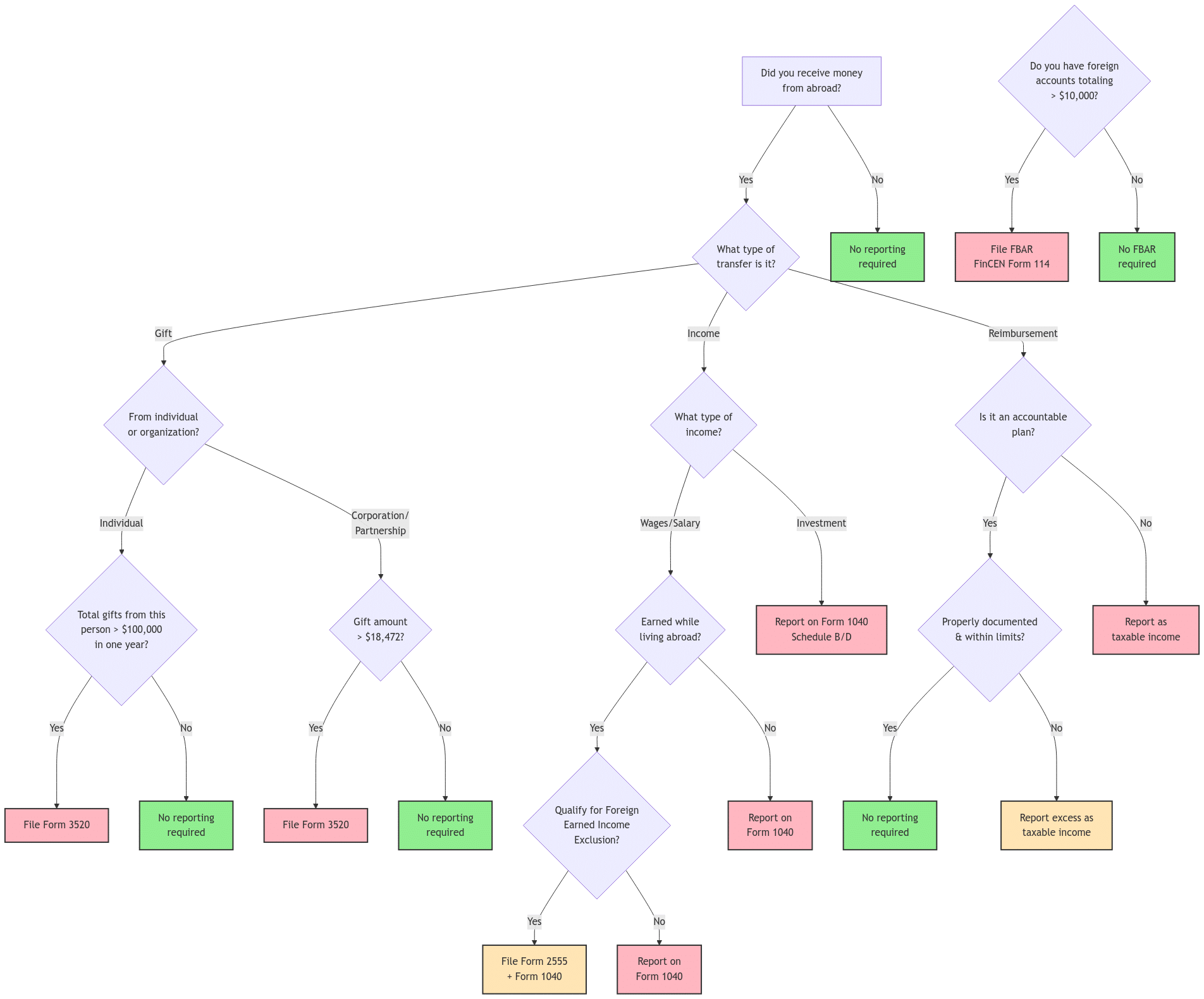

Understanding the coverage needs connected with obtaining foreign gifts is necessary for people in various industries, especially those in federal government and civil service. These demands are designed to promote openness and protect against problems of interest. Normally, receivers must report any kind of foreign gifts surpassing a specified monetary limit, which differs by territory.

Documentation is important, as receivers have to give details such as the value, nature, and resource of the present, in addition to the day it was received. Many organizations require receivers to submit their records within a marked duration, typically within thirty days of invoice.

Failing to abide by these reporting responsibilities can bring about severe repercussions, including legal penalties and damage to one's professional reputation. Consequently, understanding the particular guidelines suitable to one's setting and jurisdiction is essential for guaranteeing conformity and keeping honest requirements in civil service.

Finest Practices for Handling International Presents in Organizations

To effectively take care of international gifts within organizations, establishing clear plans and procedures is vital. Organizations needs to begin by specifying what Website makes up an international present and identifying the pertinent reporting needs to ensure compliance with legal commitments. Routine training sessions can enhance personnel awareness of these policies, advertising a culture of transparency and diligence.Furthermore, companies must execute a central radar to record all foreign gifts got, consisting of details such as the resource, value, and function. report a foreign gift. This system ought to promote regular testimonials and audits to analyze compliance with established policies

Frequently Asked Questions

Can Foreign Gifts Influence Organization Choices or Relationships?

International gifts can especially affect service decisions and relationships, usually creating regarded responsibilities or predispositions. Such impacts might influence settlements, collaborations, and general corporate values, possibly leading to problems of rate of interest or reputational risks.click resources

What Are the Charges for Failing to Report Foreign Gifts?

Falling short to report foreign presents can result in substantial charges, consisting of fines, corrective action, or lawful effects. Disobedience threatens openness and might damage credibilities, highlighting the significance of adhering to reporting policies.Exist Particular Nations With Stricter Present Rules?

Specific nations, like China and Saudi Arabia, implement more stringent guidelines on gifts, mirroring social standards and governmental oversight. These policies might influence foreign communications and require mindful consideration by individuals involving in cross-border connections.How Can Organizations Educate Personnel Concerning Foreign Present Policies?

Organizations can inform employees regarding international gift policies with normal training sessions, comprehensive manuals, and clear communication channels. Engaging workshops and real-life circumstances aid enhance understanding, making certain conformity and awareness of prospective honest dilemmas.What Documentation Is Required for Foreign Gift Coverage?

Documents for international present reporting commonly includes a comprehensive description of the gift, its value, the contributor's info, function of the gift, and any suitable plans or laws governing the acceptance and coverage of such presents.Foreign gifts are items or benefits received from international entities, which can include individuals, federal governments, or organizations. Recipients have to browse complex guidelines that govern the coverage and approval of international gifts, ensuring compliance with both worldwide and Check Out Your URL residential laws. Recognizing the definition and implications of foreign gifts is essential for individuals and organizations to keep stability and responsibility in their transactions with international entities. Receivers must browse complicated regulations that control the acceptance of international presents, as failure to do so might result in lawful repercussions, including penalties or sanctions. Failing to report foreign presents can result in significant penalties, consisting of penalties, disciplinary activity, or legal effects.

Report this wiki page